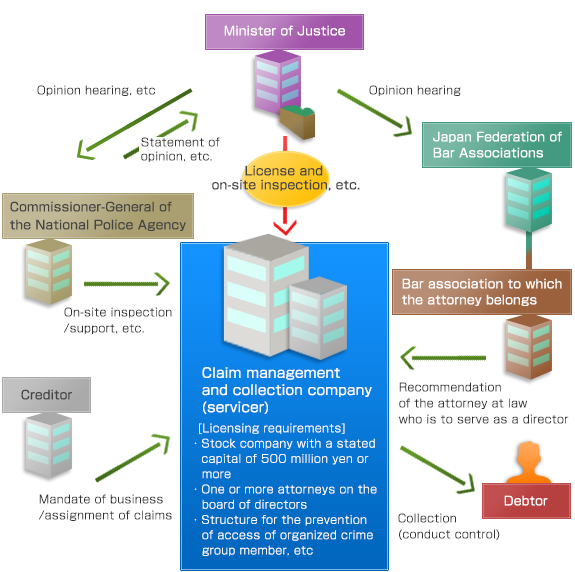

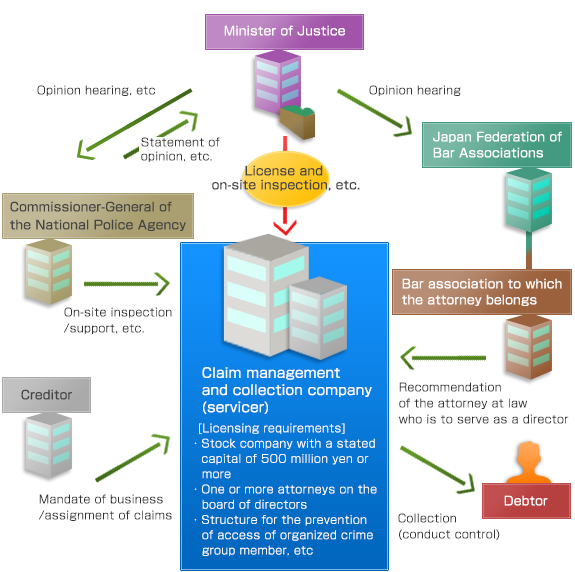

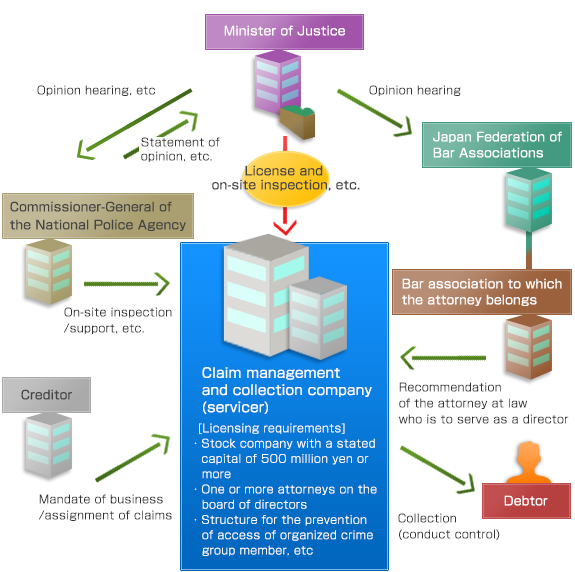

Claim Management and Collection Companies (Servicers)

- A credit collection company (servicer) is a specialist private-sector claim management and collection entity authorized by the Minister of Justice to manage and collect specified monetary claims under entrustment or assignment from a financial institution.

- The Attorney Act prohibited parties other than attorneys and legal professional corporations from engaging in this business in Japan, but the Act on Special Measures Concerning Claim Management and Collection Businesses (the Servicer Act) was enacted to promote the disposal of non-performing bank loans, paving the way for the establishment of such private companies as an exemption from the Attorney Act.

Specified monetary claims

As stipulated by the Servicer Act, specified monetary claims are primarily the following kinds of monetary claims.

- Monetary claims held by financial institutions

- Lease and credit claims

- Monetary claims relating to asset liquidation

- Monetary claims held by a factoring company

- Monetary claims held by a party undergoing legal bankruptcy proceedings

- Claims arising from a contract of guarantee

- Claims established by other governmental ordinance

The structure of the Act on Special Measures Concerning Claim Management and Collection Businesses